VCs spend a record-breaking $16.2 billion on clean energy in 2022 in USA; over $70 billion globally

Q4 2022

Clean Energy Report

March 9, 2023

Fill out the form to download a preview of this report. The full report is available through the PitchBook Platform.

VCs spend a record-breaking $16.2 billion on clean energy in 2022

Investors were bullish on clean energy in 2022, raising $16.2 billion to beat 2021’s deal value record of $16 billion even as other sectors got swept away by the bear market tide. However, VC deal value and count both dipped year-over-year in Q4. Our Q4 2022 Clean Energy Report dives into the major trends and emerging opportunities in the sector.

Key takeaways:

- Total VC dollars raised in clean energy fell 46.5% YoY in Q4 as the market calmed and fuel prices dropped.

- Renewable-powered batteries are poised for a takeoff. Grid-scale battery development picked up steam in Q4 with two huge deals, a $450 million Series E for TPG-backed Form Energy and $280.5 million Series B for Hithium, backed by ABCI Securities and CCBT Private Equity.

- Investors are increasingly confident that green hydrogen could be a viable and scalable alternative to fossil fuels, as 2022’s energy crisis caused a reckoning for natural gas.

Table of contents

| Vertical overview | 3 |

| Q4 2022 timeline | 4 |

| Clean energy landscape | 5 |

| Clean energy VC ecosystem market map | 6 |

| VC activity | 7 |

| Emerging opportunities | 13 |

| Renewables-coupled batteries | 14 |

| Green hydrogen | 15 |

| Select company highlights | 16 |

| Hithium | 17 |

| Swell | 19 |

| Tree Energy Solutions | 21 |

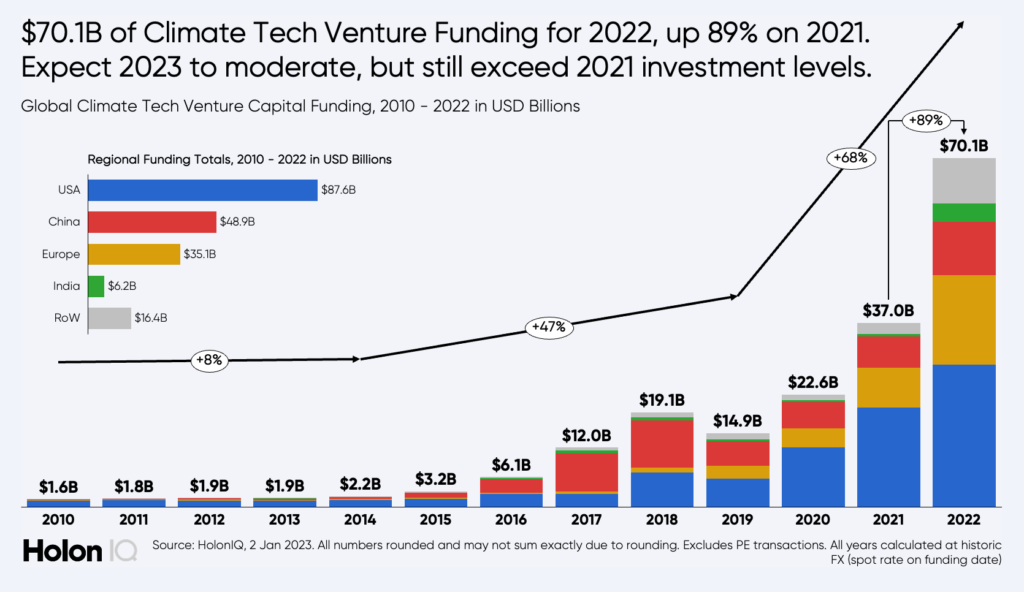

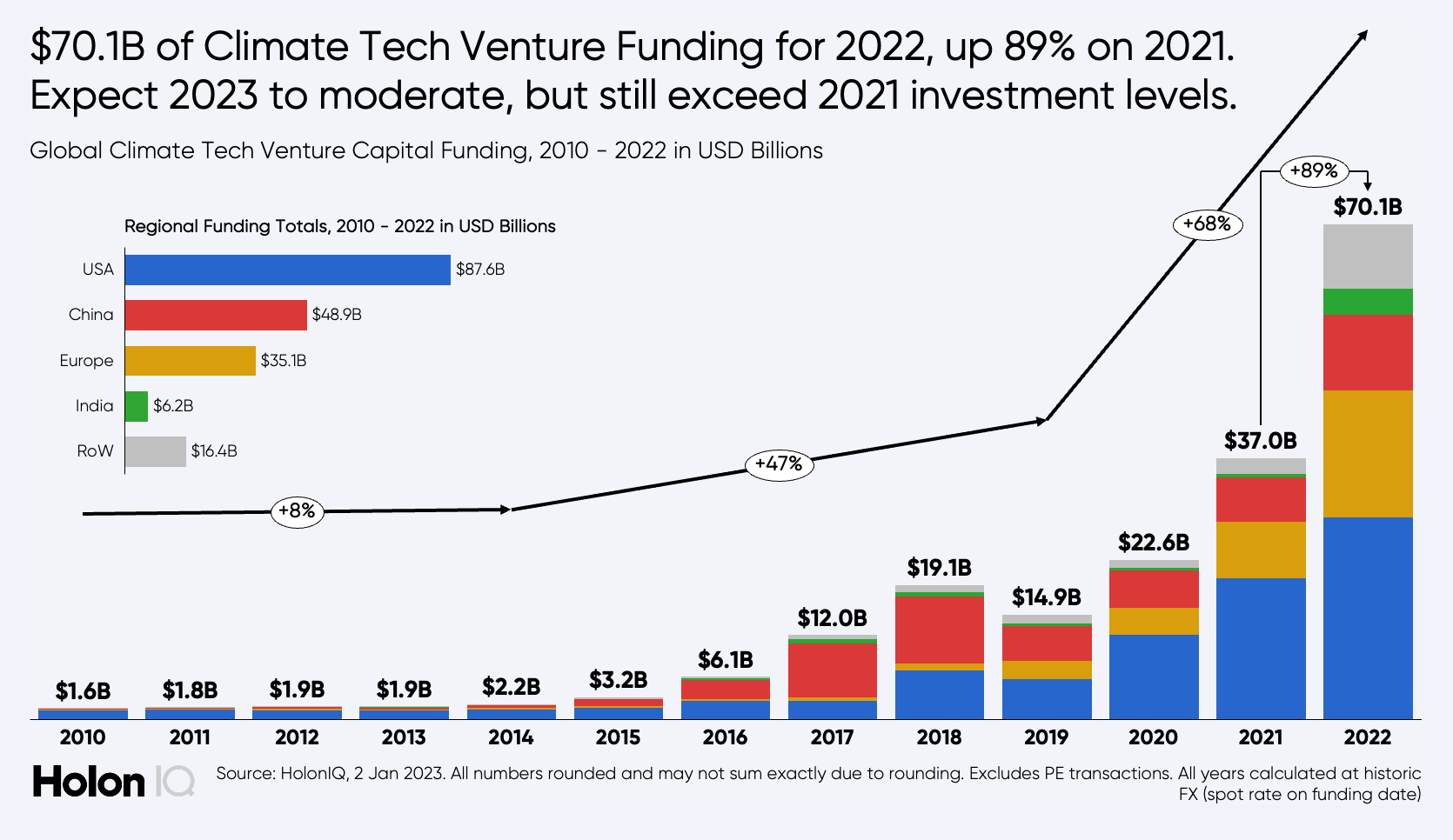

See also global numbers from Holon: