“All of the above” and a variable tax?

from SlowBoring.com

America needs an actual plan to boost domestic energy

All of the above, for real

|

|

The price of energy and other key commodities including wheat and nickel are soaring thanks to Russia’s invasion of Ukraine and subsequent western sanctions.

This is happening even though the initial round of sanctions was deliberately designed to not target the Russian energy sector in order to minimize blowback on western consumers. The problem is that you can’t devastate Russia’s economy without also hurting inputs to the energy production system. And now at the urging of Joe Manchin and Republicans, the United States is poised to bar imports of Russian oil. Meanwhile, European countries say they’re looking to cut down on Russian gas imports, and the Russians keep threatening to cut off European gas supplies.

Many people have endured much worse sacrifices during times of war than high gasoline prices. But the Republicans who’ve pushed this line are playing a comically transparent game, where they call for policies that raise the price of gasoline and then blame Joe Biden for gasoline being expensive.

This Marco Rubio tweet perfectly encapsulates what Republicans are doing here — describing a slogan (“start producing more American oil again”) as a “plan,” even though there is in fact no plan to accomplish this.

Stop importing Russian oil

Start producing more American oil again

That’s the plan

— Marco Rubio (@marcorubio) March 8, 2022

Mitch McConnell, similarly, accused Democrats on Monday of waging “a holy war against our own American energy production here at home.”

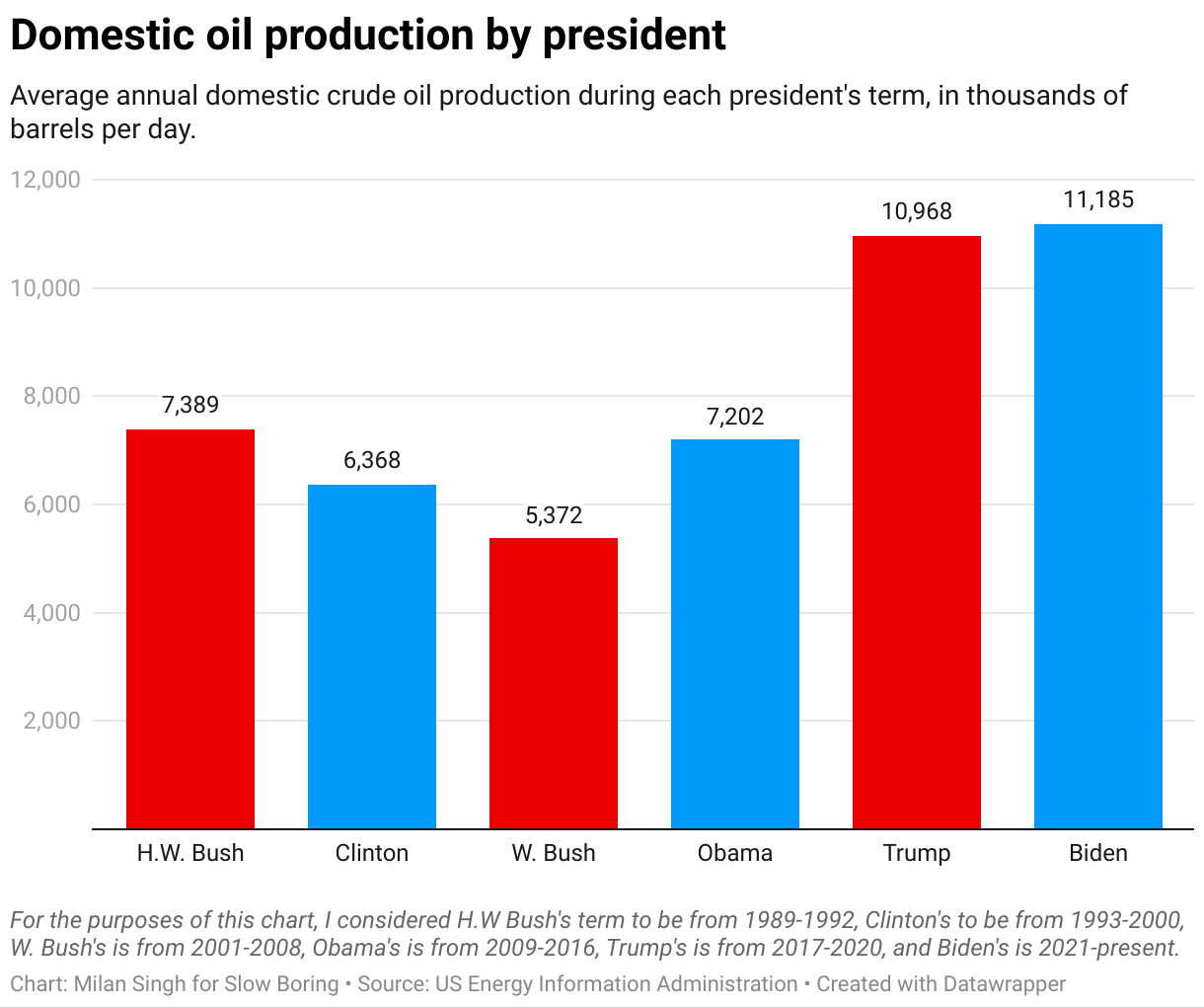

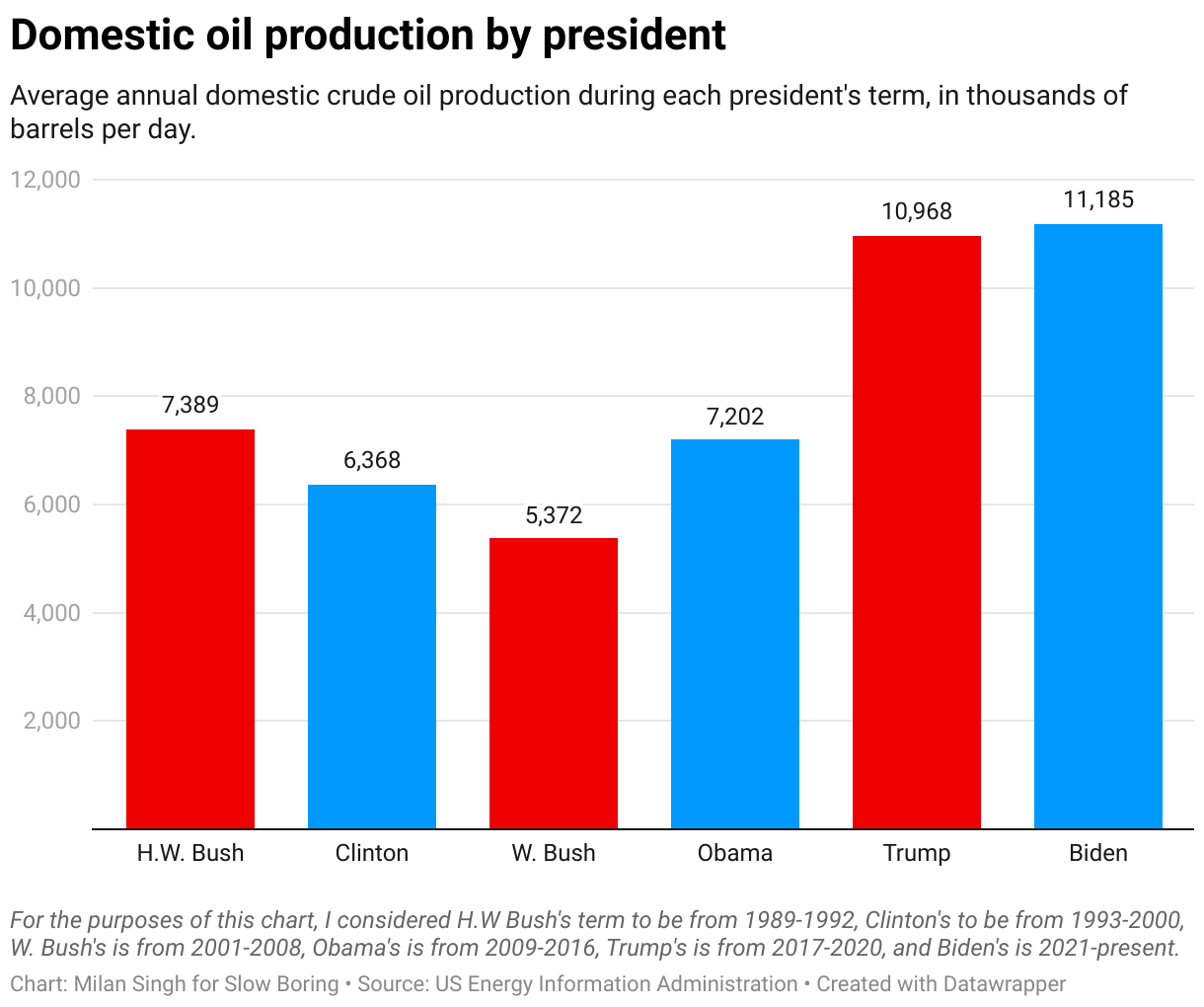

But here are the facts: across Trump’s four years in office, the United States produced 10.97 million barrels of oil per day, while Biden’s first year saw the domestic production of 11.19 million barrels per day.

Production obviously didn’t go up because Biden pressed a magic “pump more oil” button since presidents don’t actually have such a button. But if a holy war on domestic production were being waged, you’d expect to see less rather than more production.

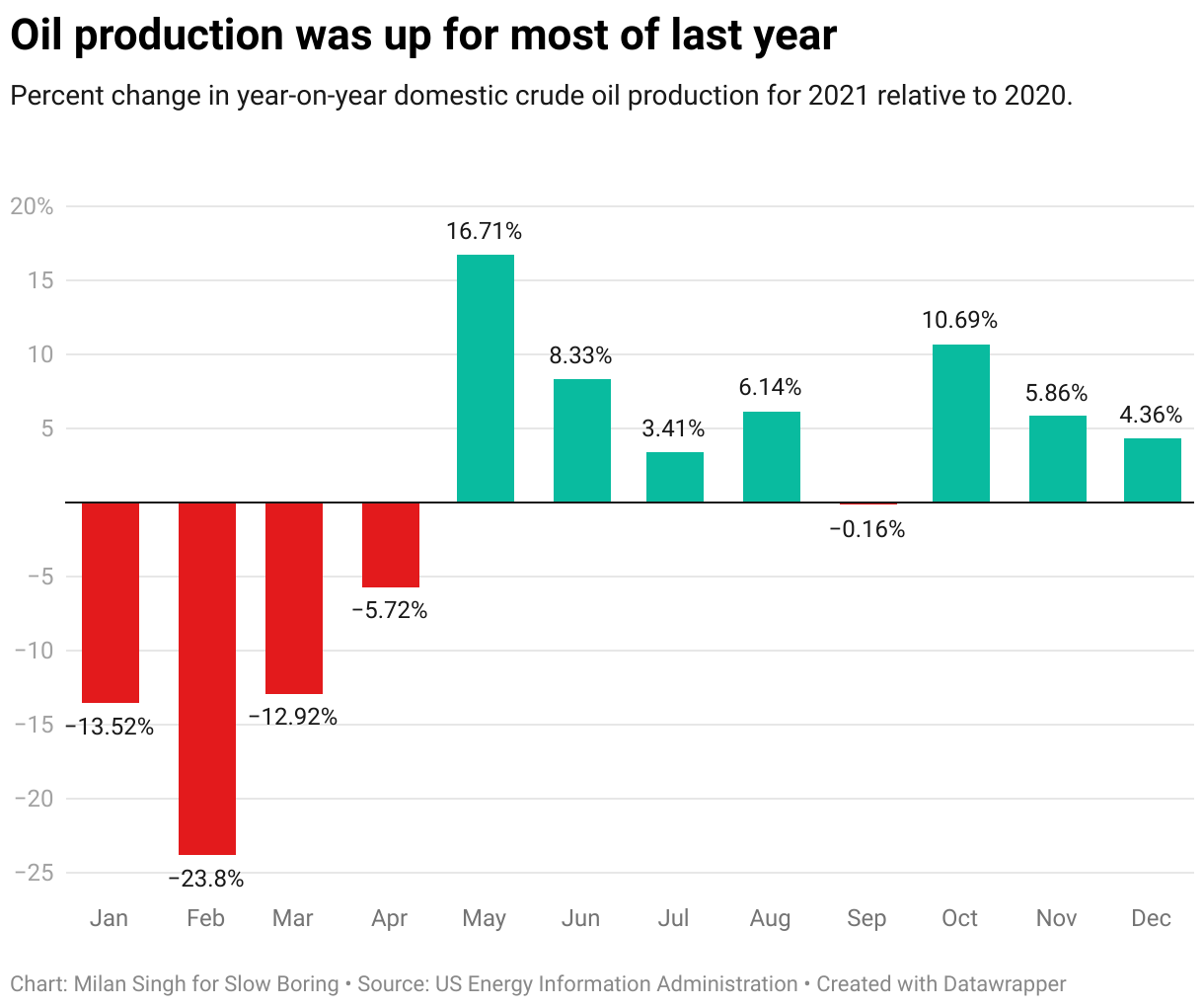

We are not devoid of policy options, but domestic oil output is in fact rising at a decent clip.

Trying to raise output even faster takes time and money. And even with prices high, it’s not necessarily an attractive value proposition. Oil companies are already drilling the most promising wells available to them. In order to drill even more, they’d need to start looking at less promising locations even as the cost of adding even more labor and equipment rises. The return on investment falls, in other words. And after a decade in which U.S. oil output surged but energy investors lost their shirts, Wall Street is pushing oil companies to kick their windfall profits out as dividends rather than reinvest in more production.

Economics is restraining domestic oil production

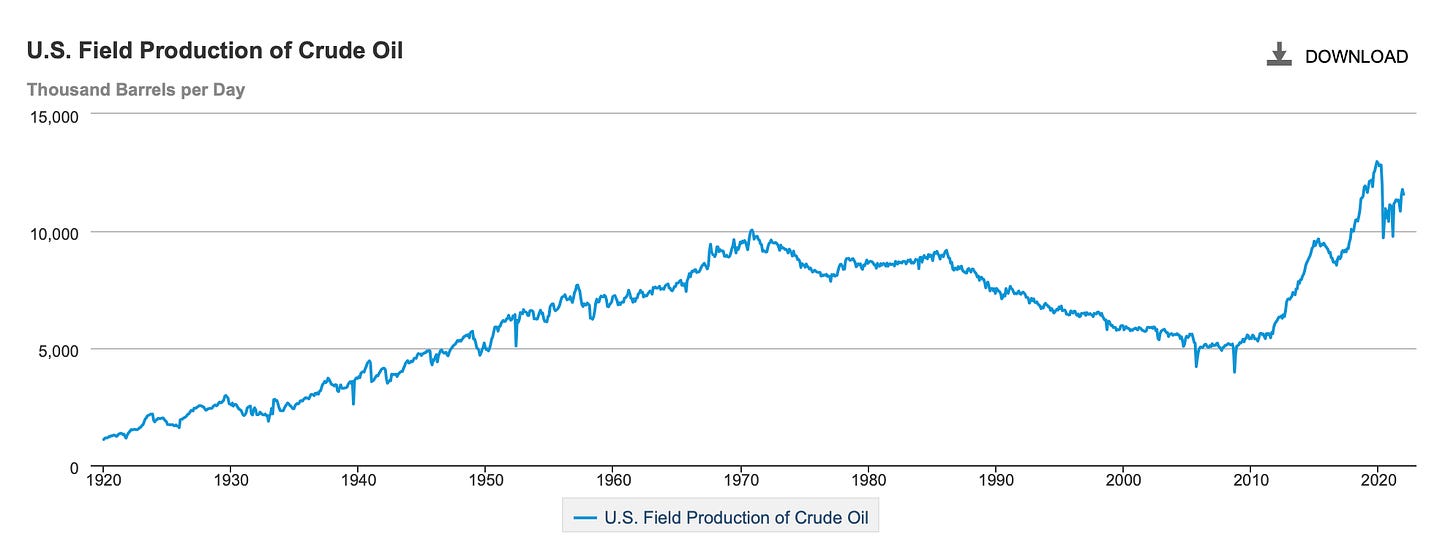

If you look at a chart of U.S. oil production over the last 100 years, you can see that for roughly 40 years, output is fell regardless of global oil prices. Then around 2011, production lifts off tremendously but also becomes much more variable.

This is much more a story about economics, geology, and technology than it is about public policy. Around 1970, we started to run out of easily accessible domestic oil reserves. Even a really prolonged run-up in oil prices such as we saw in the 1970s or the 2000s didn’t increase domestic production because there simply wasn’t the ability to do it.

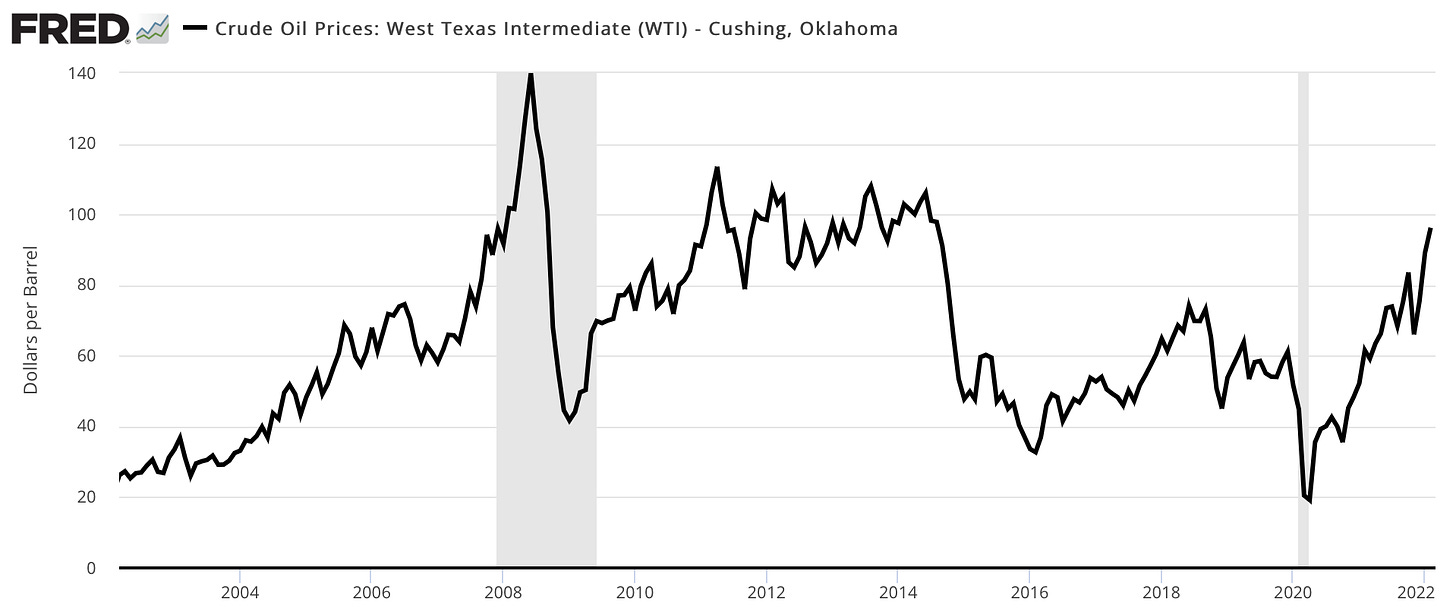

Output started to soar not because politics changed (you couldn’t find a more temperamentally or ideologically pro-oil president than Bush), but because innovations in hydraulic fracturing and horizontal drilling made it possible to reach new oil reserves. But notice that in the shale era, while the trend line is generally up, it’s also very unsteady. Many of the places where drilling occurs in the United States are now “swing producers,” where the question of what is and isn’t profitable to drill hinges pretty directly on the global price of oil. When prices rise, output rises, too. But when prices crash, output crashes. The problem with the boom-bust cycle that we had under Obama and Trump is that it leaves people a bit scarred.

Rather than the soaring output making investors rich, the stock prices performed terribly and lots of investors lost big. Tons of people got good-paying jobs but then saw those jobs suddenly vanish.

So now that prices are soaring again, there is hesitation to go all-in on increasing production as fast as technologically possible. After all, the war could end unexpectedly at any point and Russian oil could flood back onto the market. Or OPEC could flip flop as they did in 2019 and surge a bunch of cheap oil into the world to try to drive frackers out of business. There’s an alternate universe version of Elizabeth Warren in which she is holding this situation up as the canonical example of shareholder supremacy holding back the American economy: oil companies, at the behest of Wall Street, are prioritizing debt retirement and buybacks over investments in new production.

And while neither Republicans nor Democrats are talking about it, you could imagine someone calling for massive state intervention — nationalizing oil companies and directing them to focus on maximizing output rather than profit. Or the Defense Production Act could accomplish the same thing.

But this would all be somewhat contrary to the interests and desires of the oil companies. They’re basically asking for regulatory changes that would reduce their underlying cost structure and make them more profitable. But they are not currently lacking for cash flow; it’s a question of whether that cash flow goes into new output with lower marginal return on capital or if it’s returned to shareholders.

Now more than ever

Any time there’s a crisis, a lot of policy advice has a “now more than ever” flavor, with people reiterating ideas that they believed in before the crisis and would support one way or another. I always have mixed feelings about this kind of thing. On the one hand, it would be the height of intellectual dishonesty for me to claim that Putin’s invasion of Ukraine is the reason I believe advanced geothermal drilling projects on federal land should have regulatory parity with oil and gas drilling projects. That’s something I believed long before the crisis, and while I think the payoff to doing it is potentially very large, it’s both somewhat uncertain and too slow-moving to meaningfully impact the situation in Ukraine.

That said, it’s perverse not to talk about ideas that you believe deserve more attention. The Ukraine situation has everyone thinking about energy, about the virtues of abundance and domestic supply and redundancy. Even if you could create a scenario where utility-scale solar plants with massive overbuilding and battery backup met 100 percent of domestic energy needs, it might still be nice to have a more diverse energy ecosystem. So I really do think Congress should pass the Risch-Fulcher bill on geothermal permitting, and if the war in Ukraine spurs Congress to do so, that would be great.

And I have a lot of ideas like this:

- Most notably, the zero-carbon energy production tax credits from last year’s Build Back Better proposal are really good. Pair those with deficit reduction and some provisions to reduce healthcare costs and you’ve got a Putin-owning, inflation-fighting bill to headline the 2022 legislative agenda.

- Elon Musk is right that Europe should reverse its de-nuclearization.

- For some reason maybe related to his solar power business, Musk didn’t mention that basically the same logic applies to Diablo Canyon and Indian Point and other facilities in the United States.

- Most people live in places where the built environment is so inherently hostile to transit that it’s not a feasible option. But there are lots of good options for improving transit in the New York, D.C., Boston, Philadelphia, Chicago, San Francisco, and Seattle areas that would make a big difference in people’s ability to respond to price shocks.

- The built environment itself is in part a consequence of policy, and changing zoning to permit denser construction on expensive in-demand land would be a very good idea.

I’m not going to go on and on about this; people who read this newsletter probably know what I think.

But since 1970 or so, the policy paradigm in the United States has pretty consistently prioritized localism in permitting decisions. That’s generated underproduction of housing (especially dense housing), it’s made it more expensive to build roads and much more expensive to build trains (because deviations from optimal routing are a bigger hindrance to effective transit construction), it’s left our housing stock older and less energy efficient than it should be, and it’s also made it harder to tap the country’s full renewable electricity potential by making it harder to build interregional electric transmission lines. Even very eco-friendly projects like offshore wind farms and utility-scale solar projects keep getting derailed by NIMBYism.

None of that stops Americans from using energy (indeed, much of it pushes energy consumption up), but if the energy doesn’t come from our backyard, it comes from Maduro’s or Khamenei’s or MBS’s or Putin’s. And it’s very bad.

Some quick fixes worth considering

The U.S. government was setting records for Gulf of Mexico drilling bids last year, which was at odds with some of the Biden Administration’s stated policies and mostly generated negative press for them. The administration’s line was that this was something they were legally required to do in terms of the existing statutes. But progressives criticized that legal theory. Then a conservative district court judge in Louisiana issued a national injunction against the Biden administration’s effort to change the federal government’s official Social Cost of Carbon number. The idea there was to create a legal regime that’s friendlier to oil and gas extraction. But what actually happened is that on February 22, the Interior Department announced that it needs to pause reviewing all new oil and gas lease applications because the climate analysis is tied up in court.

This went down recently enough that it’s not currently impacting supply — the gap between a lease and actual drilling can go for years — but it’s a bad look politically. It’s also totally conceivable that fighting in Ukraine will last for years. What we have right now is a random judge prioritizing owning the libs over actually producing oil and gas, which is extremely annoying, but also the administration is striking back by essentially owning him (and the fossil fuel companies) rather than making the smart decision for the economy. I am not a lawyer so I can’t say exactly how much discretion the Interior Department has here, but there are clearly some options available to them other than this total pause and they should take one.

Another issue here is the Jones Act, which requires the use of U.S.-flagged vessels for all shipping between American ports.

Right now the United States imports crude oil but also exports crude oil. We also import and export refined petroleum. Some of that is based on geographical fundamentals and which refineries are optimized for which kinds of crude. But some of it is that because of the Jones Act, it is cheaper to ship from a Mexican port on the Gulf of Mexico to the east coast of the United States than to ship from an American port on the Gulf to the east coast. The Jones Act really ought to be repealed (it creates a lot of economic problems for Puerto Rico), but one reason it hasn’t been repealed is that the president can waive it in various circumstances. Biden should do that to minimize shipping costs and maximize flexibility.

There’s also scope for action around the rules requiring that gasoline be blended with ethanol. This blending sometimes makes sense economically but often does not, and environmentalists have been saying for years (and continue to say) that there are no environmental benefits to doing this. Iowa used to be a very important state in American politics but that seems to be less true these days. Back in December the EPA already reduced biofuel requirements somewhat, and Biden should continue that roll back as far as possible, not only to reduce energy costs but also because the war is putting upward pressure on the price of staple grains. Mandating the use of economically inefficient levels of biofuels is a double-whammy to both food and energy prices that the world can’t afford.

In terms of short-term politics, Biden should clearly align himself with energy abundance.

His administration has been talking about their efforts to boost domestic renewable production and transition to heat pumps and EVs, and that’s all correct and they should talk about it. But they should also identify some stuff they weren’t pushing in 2021 and say that in light of the emergency, they are now for it. Most of the levers you could pull here like the Keystone XL pipeline wouldn’t actually have a short-term impact, but the same is true for Biden’s clean energy policies. It’s still good to talk about what you’re for, and Biden should shift from “I’m for more renewables to fight climate change” to “I’m for more of everything to stick it to Putin while fighting climate change.” One way to think about it is that the current sanctions are an attack on global CO2 emissions that’s drastically more ambitious than anything American environmentalists could possibly have achieved outside of the war context. The net impact of a bipartisan effort to sanction Russia and bipartisan support for American drilling is still less aggregate fossil fuel production than what we would have had absent the war. And it could help get buy-in for renewables.

Meanwhile, on a policy level, we should learn some lessons here.

America should address oil price volatility

The United States levies taxes on gasoline that are very low compared to other developed countries. This generates excessive pollution, but I also think it is a really bad economic policy. For starters, it tends to encourage Americans to buy very gasoline-intensive vehicles, which then leaves us more economically vulnerable to disruptions in global oil supplies.

But the other thing is that the consumer-side volatility is just per se undesirable. It saddles the typical American family with what’s basically a form of uninsurable risk. A European-style high fuel tax regime also means that gasoline prices are less variable because the tax, which doesn’t change, is a higher part of the end cost to consumers. You could further optimize this by making the tax itself vary inversely with the global price of oil. When oil gets cheap, the gas tax rises, and consumer prices don’t fall that much. But when oil gets expensive, the gas tax falls and consumer prices don’t rise that much. It would be essentially a social insurance program for gasoline; drivers would pay into it during periods of cheap oil and then benefit during periods of expensive oil.

Any country could do that on the consumer side to help address volatility.

What’s interesting, though, is that since the United States is so big and also such a major swing producer and also has so many geopolitical interests, we could and should be doing more to try to stabilize the underlying price of oil. As of this week, the price of a barrel of West Texas Intermediate crude has surged to over $125 a barrel.

In the face of that, we could completely empty the Strategic Petroleum Reserve, not so much to bring prices down (though hopefully it would help) as to give us the chance to fill it back up again. We’d say that if oil goes back down to $90, we’ll fill 10 percent of it back up with American-drilled oil. At $85, we go to 25 percent full. At $80, it’s half full. At $75, we go to total fullness. And if we have any allies who want to join us in this action, we will cover half the price of the refilling.

We could also commit during this period to investing in adding storage capacity, so if the price gets down to $70 we can buy even more oil. And as a foreign assistance project, we should help other friendly democracies establish their own strategic reserves that can start being filled if oil hits $70. The idea is that to bring prices down during this moment of crisis, we need to reassure drillers that prices won’t get too low in the future. And then once this system is up and running, it can operate for however long it takes to transition America’s car and truck fleet to electricity — buying low and selling high to try to reduce the scale of price fluctuations and keep a relatively constant number of people employed in the industry rather than the current situation where it’s hard to recruit marginal workers because they know they’re at high risk of being laid off.

Don’t take the specifics of that proposal too literally (here’s a recent proposal along these lines from Employ America that has a few more details). I’m just tossing off round numbers and it really should be examined in more detail. But I think the spirit of it is correct and that trying to spur more production in the short-run by guaranteeing that oil won’t get too cheap in the future is broadly consistent with progressive climate goals, unless you live in a fantasy world where you don’t think there will be a political backlash to expensive energy.

Subscribe to Slow Boring

Passion and Perspective from Matthew Yglesias