The UK’s windfall tax on renewables could hurt decarbonization efforts

Never underestimate the power of incumbent special interests to feather their own nests. We rely on Market incentives, which are a function of the TOTAL cost of ownership.

Never underestimate the power of incumbent special interests to feather their own nests. We rely on Market incentives, which are a function of the TOTAL cost of ownership.

Despite a high-profile promise to boost ambitions at last year’s U.N. climate summit, nations have shaved just 1 percent off their projected greenhouse gas emissions for 2030, a new United Nations report found — leaving Earth on track to blow past a safe temperature threshold by almost a full degree.

Credit Suisse published a research note about America’s new climate law, The Inflation Reduction Act, the bank argued, is even more important than has been recognized so far: The IRA will “will have a profound effect across industries in the next decade and beyond” and could ultimately shape the direction of the American economy,

The Inflation Reduction Act established a “Greenhouse Gas Reduction Fund” to finance clean energy projects across the country. Now, Nevada’s green bank, the Nevada Clean Energy Fund, is positioning itself for some of the $27 billion authorized.

from WaPo The Inflation Reduction Act will cause the cost of renewable energy to decline dramatically over the next decade, according to an analysis shared exclusively with The Climate 202. The analysis from ICF Climate Center, a global consulting…

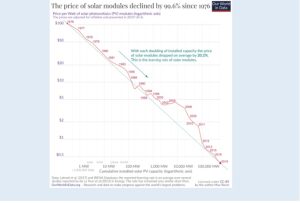

Electricity from fossil fuels used to be far cheaper than renewables. This has dramatically changed within the last decade. The fundamental driver of this change is that renewable energy technologies follow learning curves, which means …

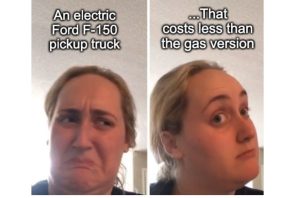

To BEV or not to BEV, that is the question Every year since 1981, the Ford F-150 has outsold every car in America. The F-150 lineup is responsible for $40B+ in annual revenue. As an American product, it…

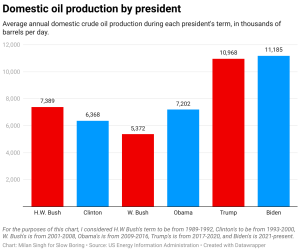

Matt Yglesias (slowboring.com) offers a very useful discussion about the interaction of oil prices, gas taxes, investment and the politics involvred. I learned a LOT of things I didn’t know here. Eco-economics at its best!

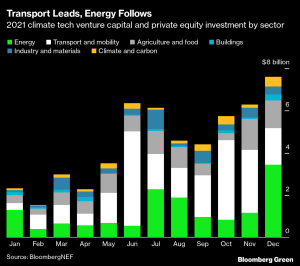

Renewable energy was the leading sector, followed by electrified transport. Most of that money will last decades (in the case of electric cars) or many decades (in the case of power generators).

A survey of 1,000 global leaders found climate and related issues as a top “risk” over short, medium and long-term time horizons.

The company pledged to be carbon negative by 2030, removing all GHGs it emitted since its founding in 1975 before 2050. BUT it has ties to anti-climate trade associations, donates to obstructing politicians & contracts with fossil firms.

As carriers price in climate risk, watch what happens — from coal to coastal condos; follow the money. Imagine how much faster this will occur if the carbon fee and dividend passed.