Permits for carbon storage projects pile up at EPA

|

As Washington wages parallel battles on permitting and new environmental regulations, one conundrum crisscrosses both: A pileup of permit applications to store carbon dioxide underground. Storing carbon will likely be increasingly important to power plants that would need to capture these emissions as one way to meet new limits on the electricity sector the U.S. Environmental Protection Agency proposed last week. The Inflation Reduction Act, passed last year, has prompted a flood of applications at the EPA, with more than 70 now pending. The law nearly doubled an existing tax credit for these kinds of projects to $85 per metric ton (MT). “Over 80% of these applications were submitted within the last 12 months,” EPA told Cipher. |

|

Source: U.S. Environmental Protection Agency • Data last updated on April 24, 2023. Excludes approved permits and withdrawn applications. |

|

U.S. Sen. Joe Manchin, a Democrat representing West Virginia who plays an outsized role influencing congressional action, criticized the EPA for pushing carbon capture tech in its new power plant proposal while storage permits await action at the agency. “Don’t tell me that you’re going to invest in carbon capture [and] sequestration, when we can’t get a permit to basically sequester the carbon captured,” Manchin said at a May 11 Senate hearing on permitting. EPA doesn’t consider the permits in backlog. A spokesperson told Cipher the agency has set a goal of “issuing permits within 24 months of receiving a complete application,” and all the permits currently under review were submitted within that time frame. The Louisiana-based company Gulf Coast Sequestration, which is developing a carbon storage hub in the state, is one of the companies stuck in regulatory limbo. “We can’t fully develop the projects until we have the permits to store,” Gulf Coast Sequestration CEO and President Benjamin Heard told Cipher. That means an agreement the company has with the Switzerland-based Climeworks, which would supply it with CO2 captured directly from air, can’t move forward. Gulf Coast Sequestration applied for its permits in 2020 and 2022. EPA informed the company its permit applications were complete in September 2022 but still needed to undergo technical reviews, which can take up to two years. Carbon storage is one of numerous permitting bottlenecks across the energy landscape that are—somewhat ironically—being worsened by the recent passage of IRA and the 2021 infrastructure law designed to supercharge America’s shift to cleaner energy. Last week, the White House outlined its perspective on how to streamline permitting for all types of clean-energy infrastructure, including carbon storage, with Senior Advisor John Podesta emphasizing the current pace is “unacceptable.” Capturing and storing carbon is essential to limiting the worst impacts of climate change, according to the United Nations Intergovernmental Panel on Climate Change. |

|

Cipher has also tackled this topic on the other side of the Atlantic. In Europe, the North Sea is emerging as a hotspot for carbon storage as countries look to the potentially lucrative future of carbon capture. |

|

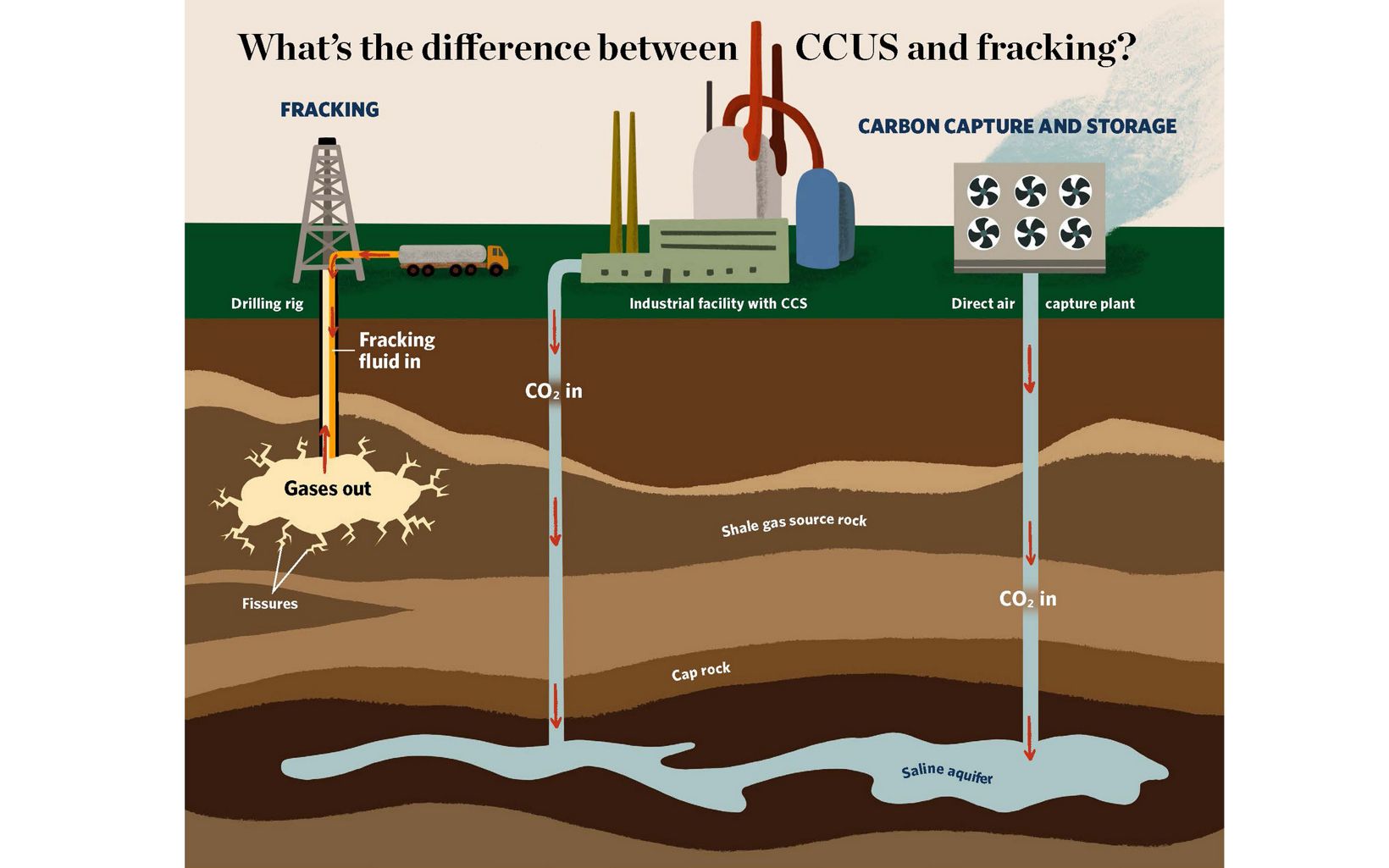

To achieve its net-zero goals, the U.S. needs to capture and store 400 to 1,800 million MT of CO2 directly from industries or from the atmosphere annually by 2050, concluded a U.S. Energy Department report released in April. Today, the U.S. has just 1- 5% of that capacity. Factoring in tax credits, EPA identified carbon capture, along with blending renewable-sourced hydrogen, as the most cost-effective approaches for reducing CO2 emissions from existing and new fossil fuel power plants starting in 2030 in its rule proposed last week. Questions persist, though, about the technology’s economic viability in this sector. Some environmentalists agree the EPA needs to expedite its review of carbon storage permits. “We know it can be done. It’s not rocket science, but it does require detailed analysis of geological formations, and it is true that it is taking too long and that we have to accelerate that timeline,” Ben Longstreth, global director for carbon capture at the international nonprofit Clean Air Task Force, told Cipher. Congress has tried to speed up the process by providing EPA with $50 million in the infrastructure law to help states set up their own permitting programs and $25 million to help EPA advance its permits. Ramping up carbon capture and storage depends largely on EPA’s ability to issue permits, the Energy Department said in its report. Once captured, all that CO2 must go somewhere secure—often underground. The EPA regulates the permanent injection and storage of CO2 in wells dug deep into rock formations to protect subterranean drinking water sources from contamination. Jay Duffy, litigation director at the Clean Air Task Force, acknowledged that permit delays are an issue but says the agency has enough time to get on track given it’s not until 2030 when such projects would commence. “I think we have more than enough time for EPA to deal with expediting those permitting issues,” he said. Carbon management analysts attribute the long wait at EPA largely to the permitting program being mostly dormant since it was first created in 2010. The agency has approved permits for thousands of wells where CO2 has been injected into the ground to extract oil in a process called enhanced oil recovery, but Longstreth said the agency lacks the same institutional knowledge about permanent CO2 storage. Enhanced oil recovery wells don’t require CO2 to remain where it was injected, while permanent storage requires frequent monitoring and seismic testing to avoid CO2 leaks into water tables, according to the Congressional Research Service. To date, EPA has approved a total of six carbon storage permits following a two to six year approval process, including for two ethanol plants in Illinois. The other four expired because they were for a now-defunct carbon capture project in Illinois, EPA said. Analysts at the cross-sector Carbon Capture Coalition say EPA could alleviate its regulatory burden if it were to delegate the ability to grant permits (known in policy circles as ‘primacy’) to states. Only two states (North Dakota and Wyoming) have received such authority so far, though Arizona, Louisiana, Pennsylvania, Texas and West Virginia are now also seeking primacy. North Dakota, which received primacy in 2018, five years after applying for it, took less than a year to issue a permit to inject CO2 underground. On May 4, Louisiana received draft approval to issue its own permits. EPA administrator Michael Regan said Louisiana’s program, once finalized, would serve as a model for other states and eventually result in timelier processes. Not everyone supports handing permitting off to states. Logan Burke, executive director of the New Orleans-based environmental nonprofit Alliance for Affordable Energy, opposes carbon capture and is “very concerned” EPA is giving well permit oversight to the Louisiana Department of Natural Resources. Burke says the state has a spotty record of safely overseeing thousands of orphaned oil and gas wells in the state. Sen. Bill Cassidy, though concerned with EPA’s pace, is pleased EPA granted permitting authority to Louisiana. “You know the old saying, the best time to plant an oak tree is 50 years ago and the second-best time is today,” the Louisiana Republican said. “They took a year to give us primacy, but it’s in place now.” |

.png?upscale=true&width=1200&upscale=true&name=image%20(88).png) |

From https://www.ciphernews.com/when-permitting-and-epa-collide