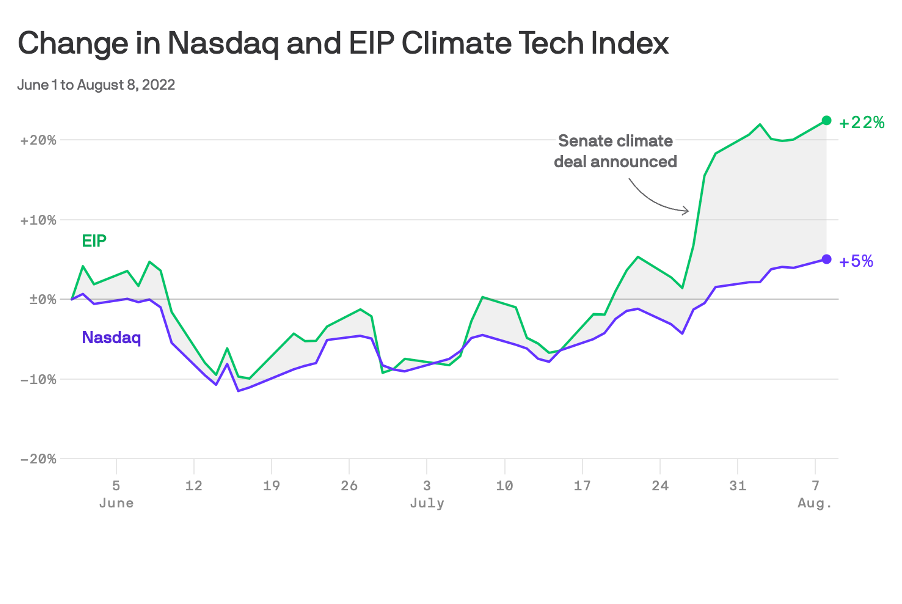

Investors like the climate deal

from Axios

The early verdicts have arrived: Investors are confident the Democrats’ climate deal will translate into expanded real-world deployment of low-carbon energy.

Driving the news: The movement of exchange-traded funds and individual companies in several segments of the energy sector tell a similar story.

- The Climate Tech Index from the VC firm Energy Impact Partners tallies a basket of companies’ performance against the wider market (though it’s not an investment vehicle).

- The index is both wide-ranging and combines new market entrants and more established players.

Zoom in: The Invesco Solar ETF is up 16% since the deal emerged in late July and passed the Senate over the weekend, while the iShares Global Clean Energy ETF is up 14%.

- Companies like EVgo (charging), Sunrun (solar), and Orsted (wind), to name just a few, have all seen gains since the surprise revival of the bill that’s heavy on expanded and extended tax breaks.

Yes, but: If the bill passes, a lot needs to happen before it translates into a deployment surge, given workforce challenges, project siting hurdles and more.

- And the bill is unlikely to end volatility in the clean energy sector, where companies are grappling with input cost fluctuations and other variables.

- “Republicans are expected to take back control of Congress this fall, so it’s important to remember that policy uncertainty contributes to their volatility and that’s unlikely to change over the next few years,” DataTrek Research’s Jessica Rabe tells Bloomberg.

What they’re saying: The CEO of wind turbine maker Vestas said this morning that the bill is “very supportive of renewable energy in the United States over the next ten years,” should it pass the House, which is expected to take up the bill on Friday, per Reuters.

- A recent note from Goldman Sachs analysts said the legislation is bullish for utilities “as the wind, solar and storage tax credits would reduce the costs of building new renewables in the U.S.”

- On solar specifically, the bill’s announcement was a “welcome surprise for investors who by that point had become less confident on climate-related policy support being passed this year,” Goldman’s note states.