Follow The Money: ¾ of a Trillion Dollars Invested

From Nathan Bullard’s Newsletter on Bloomberg.

Two weeks ago I broke down the sectors and trends behind 2021’s three quarters of a trillion dollars of energy transition investment. Renewable energy was the leading sector, followed by electrified transport, taking in a total of more than $600 billion dollars. Most of that money flows to the financing of assets that will last decades (in the case of electric cars) or many decades (in the case of power generators).

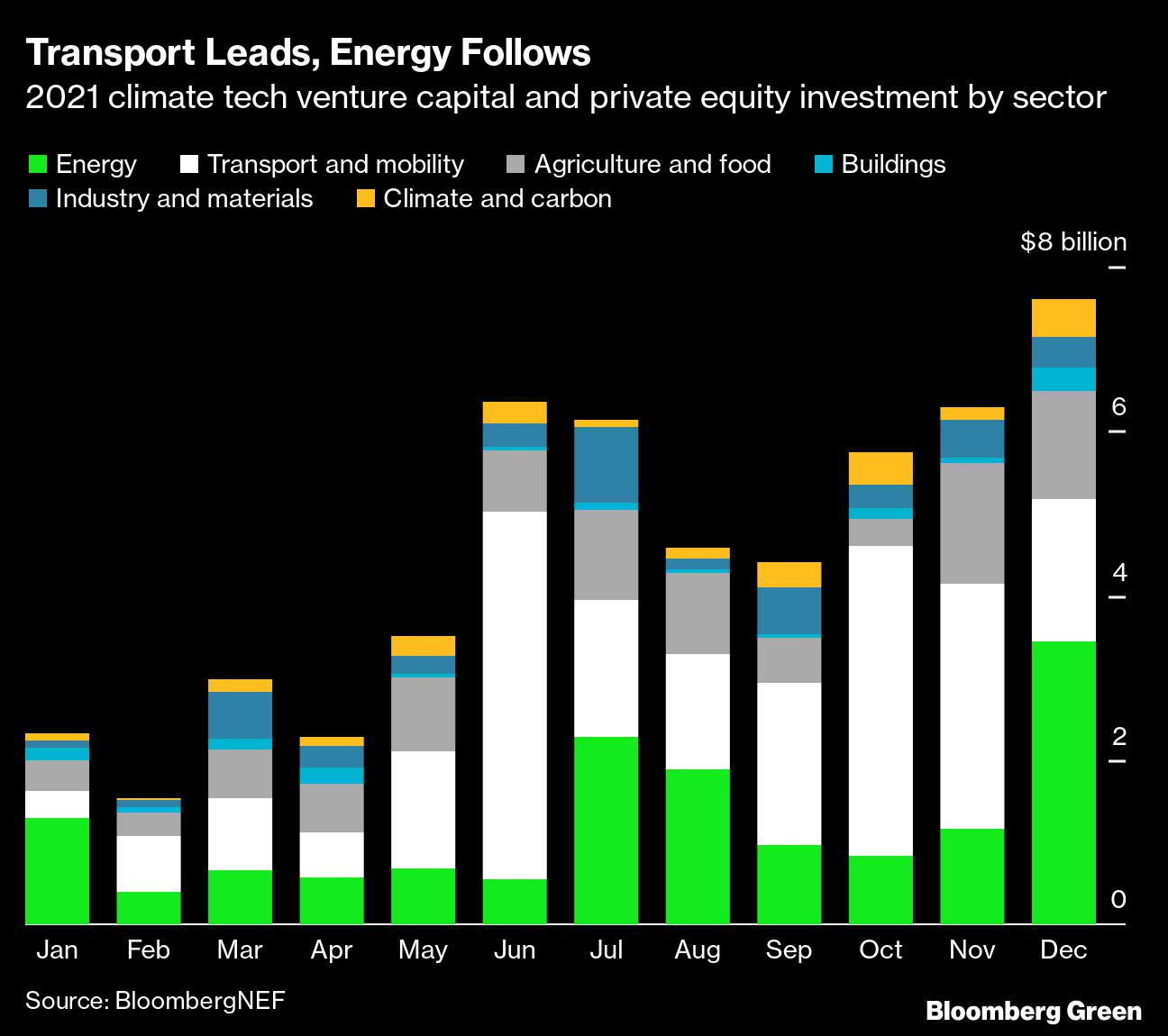

Importantly though, more than $50 billion flowed to early-stage private companies, and not just in energy or transport. A useful way to categorize that early-stage investment is either climate software or climate hardware.

An example of the former is Watershed, which this week announced that it has raised $70 million to build software that allows companies to measure their greenhouse gas emissions. Watershed’s new investors are Sequoia and Kleiner Perkins, software-focused venture capital investors who also co-invested in Google.

Mark Carney

Photographer: Simon Dawson/Bloomberg

Watershed has appointed former Governor of the Bank of England (and prior to that, the Bank of Canada) Mark Carney and influential climate diplomat Christiana Figueres as advisers. I think of the two of them as a form of software, too — adept at creating international standards and systems and engaging at the global level.

Measuring, analyzing, and pricing decarbonization challenges is important. But we also need to solve physics and chemistry problems in order to remove emissions from industrial processes, or change those processes while still producing the same or equivalent products. That’s hardware.

One initiative I have been watching closely is Swedish steelmaker SSAB’s ambitions to nearly eliminate carbon dioxide emissions from its production processes. Steel emissions are a significant source of greenhouse gases, and until recently have been thought of as intractable. Last year, SSAB said that its pathway to near-zero emissions would take until 2045. Last month, it revised that dramatically – the company now plans to do so by the end of this decade.

One hardware investment is in marine shipping. Marine diesels run on heavy, highly-polluting fuels which emit many other pollutants besides carbon dioxide. Decarbonizing shipping is also extremely challenging: marine diesel engines are long-lived, the sector is often low-margin, and an enormous global infrastructure exists to fuel today’s ships.

That makes a new initiative from the Singapore-based Global Centre for Maritime Decarbonisation quite important. The GCMD is launching a study that will experiment with using ammonia as a replacement for petroleum-based bunker fuel. There are many safety, operational and regulatory factors to work through even in the early stages of the study, and a commensurate investment is required.

Importantly, green ammonia with zero net carbon emissions can be produced via renewable energy-powered electrolysis creating hydrogen, followed by a renewable-energy powered Haber-Bosch process, combining one nitrogen molecule with three hydrogen molecules.

Deep decarbonization will need software to guide company strategy and capital deployment, and hardware to build the chemical and physical infrastructure needed to change today’s industries. Both, fortunately, are being developed today in their own ways.

Nathaniel Bullard is BloombergNEF’s Chief Content Officer.