Clean Electricity Breaks New Records

from Bloomberg NEF

- More than 40% of the world’s electricity came from zero-carbon sources for the first time in 2023; 14% from wind and solar

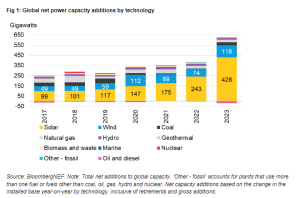

- Almost 91% of global net power capacity additions came from solar and wind in 2023 versus 6% from fossil fuels

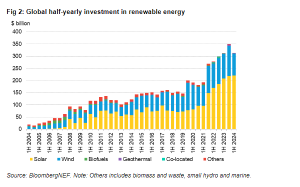

- Renewable energy attracted $313 billion of new investment in the first half of 2024, similar to the same period in the prior year

- Renewable power output rose more than 5% year-on-year, to make up nearly a third of global generation in 2023

New York, August 22, 2024 – The global transition to clean electricity has reached important new milestones and is set to continue at the current pace. According to a pair of new reports by research provider BloombergNEF (BNEF), for the first time ever, zero-carbon sources made up over 40% of the electricity the world generated in 2023. Hydro power accounted for 14.7%, while wind and solar contributed almost as much at 13.9% – a new record high. Nuclear’s share was 9.4%.

These findings emerge from two reports published today by BNEF: Power Transition Trends 2024, and the 2H 2024 Renewable Energy Investment Tracker, which indicate that momentum towards clean power has also accelerated, with wind and solar representing nearly 91% of net new power capacity additions in 2023 – up from 83% the year before – while fossil fuels including coal and gas represented just 6% of net new build – the lowest level ever.

Moreover, the renewable energy industry looks set to repeat a similar feat again in 2024, as renewable energy projects secured $313 billion of new investment in the first half of the year, on par with the first half of 2023. Despite seeing a 4% decline on the back of cheaper equipment, China continues to dominate new renewable energy investments. The US was the second largest market in the first half of 2024 and has seen half-annual investment levels rise 63% since the Inflation Reduction Act passed. Pakistan skyrocketed to be the fifth-largest market for new solar investment, up from 14th in the same period last year.

Power Transition Trends is the world’s most comprehensive review of power capacity and generation data from 140 markets – along with aggregated data from the rest of world – highlighting trends in the energy transition and the progress that nations are making toward decarbonizing their economies. The Renewable Energy Investment Tracker is BNEF’s biannual tally of new investment into renewable energy capacity globally, and equity raised by specialist companies.

“We have seen a step-change in renewable energy compared to a few years before. There’s now no question this is the largest source of new power generation, wherever you go.” said Sofia Maia, the lead author of Power Transition Trends 2024.

Among other findings highlighted in Power Transition Trends, the total global power-generating capacity reached 8.9 terawatts in 2023. Wind power alone now accounts for 1 terawatt of installed capacity, a historic milestone. However, the wind sector’s achievement is eclipsed by surging solar deployment, with a net 428 gigawatts of solar capacity added in 2023, up 76% year-on-year, to bring the total global installed solar fleet to 1.6 terawatts.

Ten economies accounted for nearly three-quarters of total renewable energy generation in 2023. Mainland China stood head and shoulders over its next-nearest competitor – as it has for a decade – with nearly one-third of all global renewable energy output last year. The US, Brazil, Canada and India rounded out the top five, which accounted for 60% of the world’s renewable generation last year.

As for global renewable energy investment in 1H 2024, the $313 billion total is lower than investment tracked in the previous six months, but matches the figures in the first half of 2023, indicating that the sector as a whole is maintaining momentum.

“Oil majors may be reducing their focus on renewable energy, but this hasn’t made a dent in global investment.” said Meredith Annex, lead author of Renewable Energy Investment Tracker. “It’s clear that if there are projects ready and able to move forward, the capital will come. The focus should be on simplifying wind and solar development around the world.”

BNEF’s research shows that solar and wind are performing differently so far in 2024.Solar investment in the first half of 2024 remained up year-on-year, reaching $221 billion for utility-scale and small-scale assets. However, the growth rate shows signs of slowing as cheaper modules mean that the same amount of capacity requires less investment and as grid bottlenecks start to take hold in some markets.

Wind investment in the first half of 2024 reached $90.7 billion, down 11% from the same period last year. Offshore wind, where investments are driven heavily by government-led auction calendars, was particularly down. Meanwhile, onshore wind faces frequent challenges around permitting and grid interconnection. Wind projects are still moving forward, but the industry has struggled to achieve the same step-change in deployment as solar.

Contacts

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.