Biodiversity Emerges as New Risk for Asset Managers After UN Summit

from Bloomberg

COP15 agreement prompts sector to sit up and take notice, with few existing funds focused on natural capital.

Fund managers who haven’t cared about biodiversity may soon find they have to.

In the early hours of Monday in Montreal, a deal was struck that has the potential to shake up the regulatory landscape for the investment industry. After four years of talks, UN negotiators hunkered down for two weeks at the COP15 biodiversity summit to produce a framework that KPMG says provides “an unambiguous message” to firms on the need to start disclosing their biodiversity footprint.

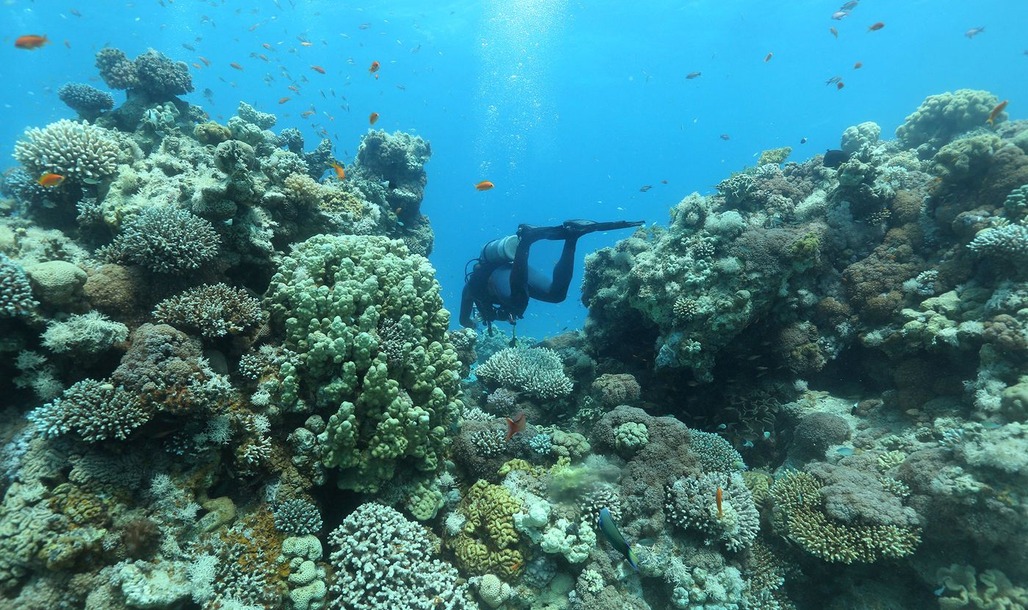

Negotiators at COP15 agreed that governments and the finance industry need to invest in such a way so as to halt and reverse nature loss by the end of this decade. The deal includes a clause on biodiversity disclosures, with the ultimate goal of shielding 30% of the world’s natural assets by 2030.

“We positively noted the adoption of requirements for all large businesses and financial institutions to assess and disclose how they affect and are affected by biodiversity, even though making this process mandatory is key for us,” Robert-Alexandre Poujade, ESG analyst – biodiversity lead at the asset management arm of BNP Paribas SA.

The inclusion of quantifiable objectives sends “powerful signals to the investment community,” said Lorenzo Bernasconi, head of climate and environmental solutions at Lombard Odier Investment Managers.

Delegates compared the accord to the landmark Paris climate agreement of 2015, which reset the regulatory framework across jurisdictions and helped turn 1.5C and net zero into a global mantra.