Trump’s Win Threatens U.S. Clean-Energy Boom

from WSJ

President-elect wants to boost fossil fuels and dial back green subsidies

ET

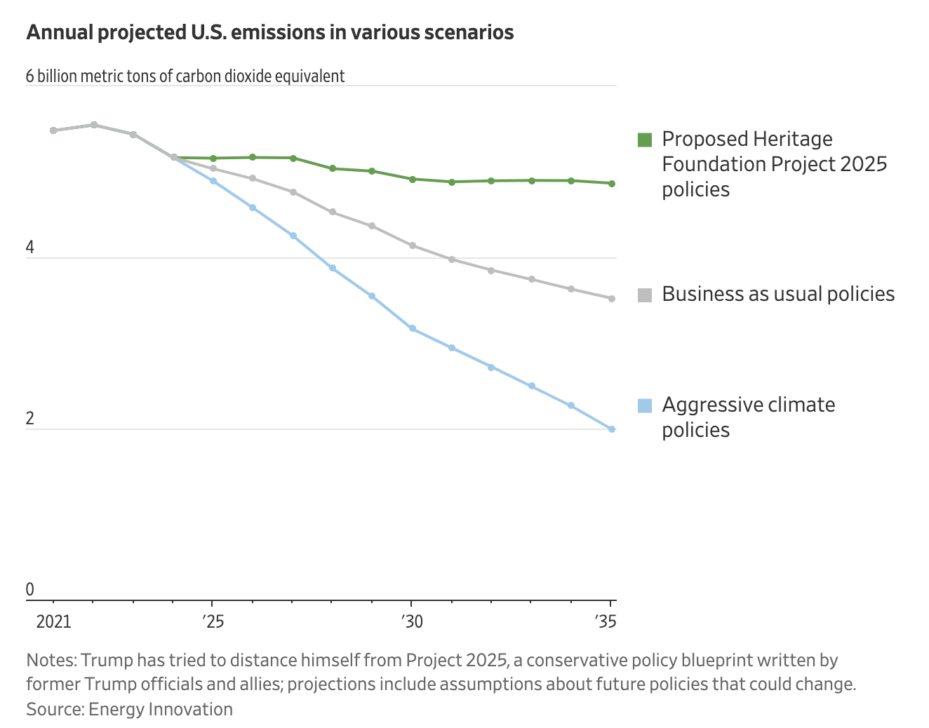

Donald Trump’s victory puts a skeptic of global warming back in the White House, triggering an about-face on climate policy that threatens to derail billions of dollars in clean-energy investment and slow a reduction in the nation’s emissions.

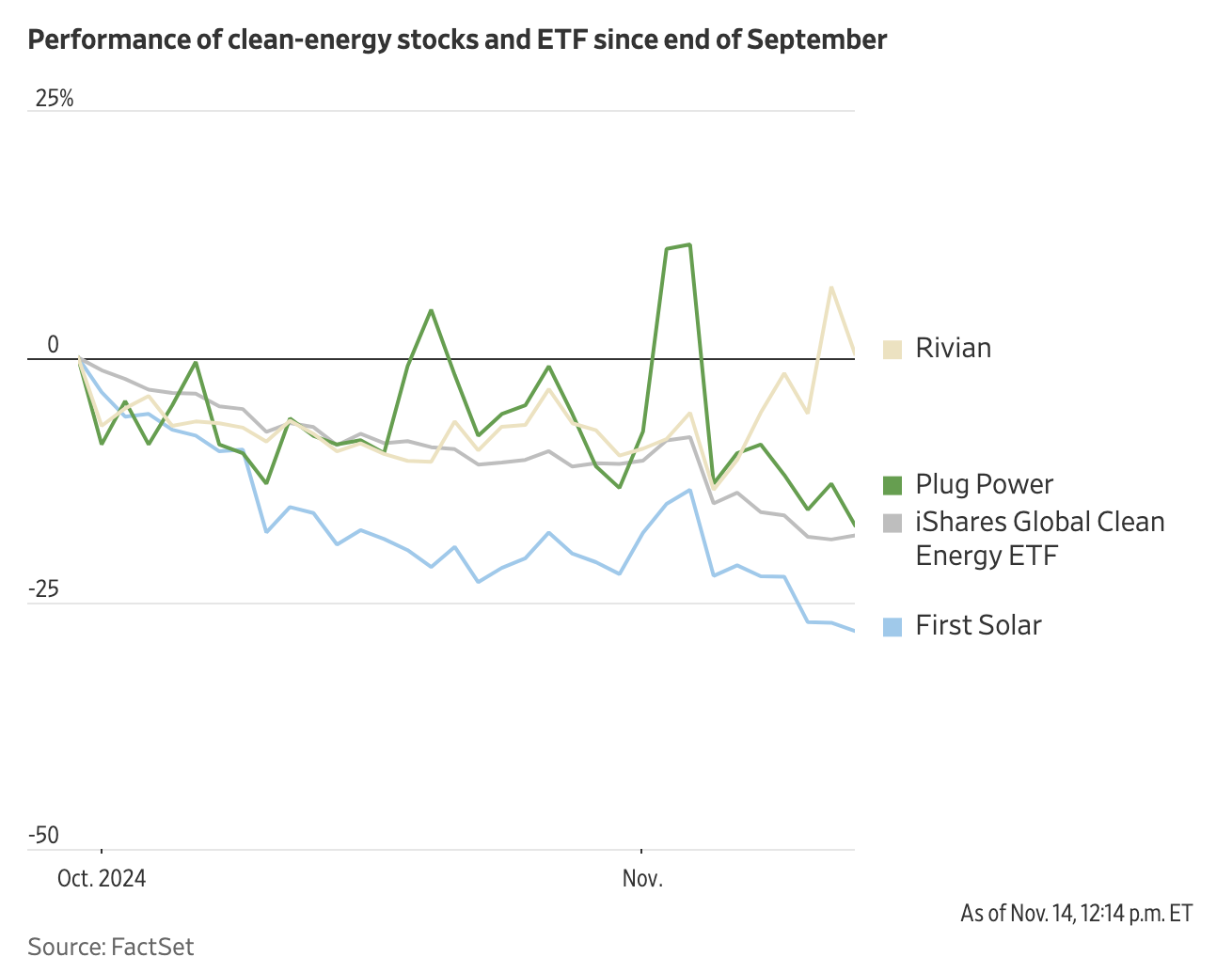

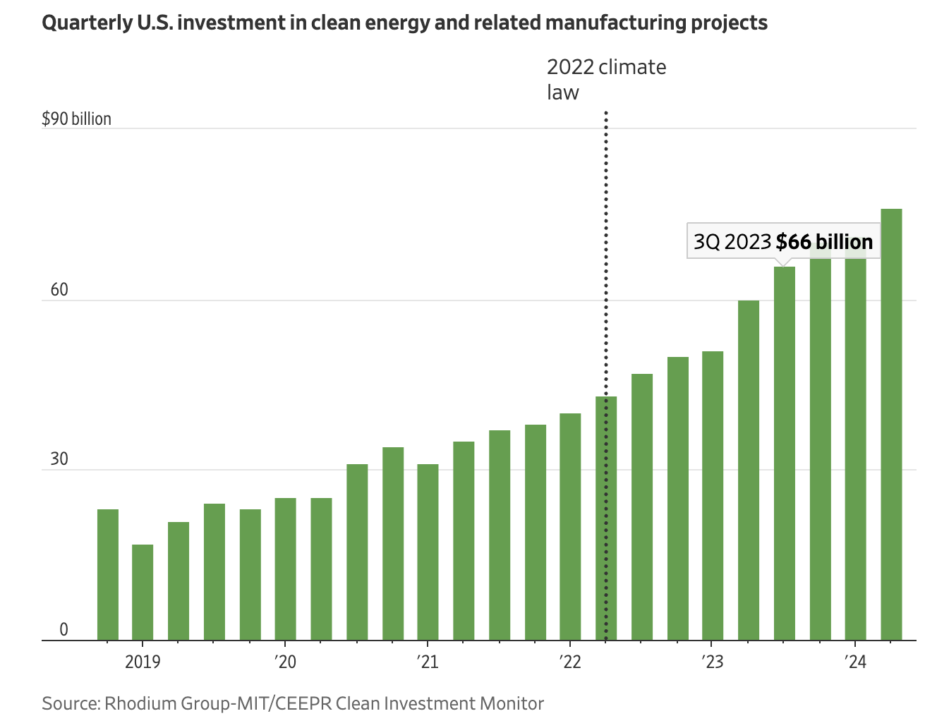

Investors dumped shares of renewable-power developers and bought oil-and-gas stocks in the days after the election. Clean-energy companies are vulnerable because Trump has said he wants to repeal a 2022 Biden administration climate law that promised to channel several hundred billion dollars of tax incentives, loans and grants into the sector.

The subsidies triggered a surge in manufacturing and jobs, most in Republican congressional districts. Trump and some Republicans say the subsidies are wasteful government overreach.

Trump also aims to rip up environmental regulations, which he says will unleash oil and gas production that is already at record levels. He has said doing so would boost the economy and the nation’s energy independence.

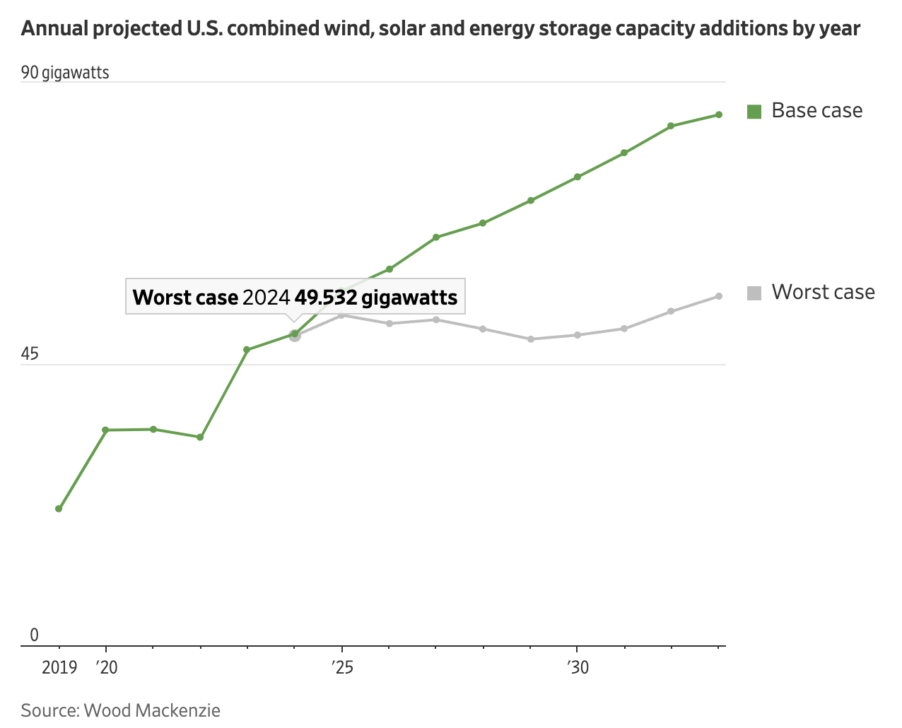

Wind and solar already make up the bulk of new power generation in the U.S., but many analysts fear slower deployments will lead to more frequent extreme weather events driven by climate change that wreak havoc and damage the economy.

“This is unambiguously bad for the future of climate policy in this country,” said Sheldon Kimber, chief executive of clean-energy developer Intersect Power. He is taking calls from investors worried about how tariffs that Trump has said he would levy on goods from China and other countries could push up costs while changes to tax credits could disrupt future project development.

Trump’s stance on climate change will be in focus in Azerbaijan at an annual United Nations climate summit that starts Monday. Countries are off track to meet their climate commitments. This year is set to be the hottest on record and first with global average temperatures more than 1.5 degrees Celsius above preindustrial levels, threatening efforts to limit global warming below that threshold.

Global emissions could climb faster if the U.S. backs out of climate agreements like the Paris accord that commit countries to pursuing emissions reductions, analysts said. The U.S. withdrew from the accord under Trump but rejoined in 2021 under President Biden.

Solar-panel maker First Solar was arguably the biggest winner from climate-law subsidies that boosted domestically made clean-energy equipment. Photo: PHOTO: Sylvia Jarrus for WSJ

Many experts don’t expect Trump to fully repeal the climate law known as the Inflation Reduction Act, a move that would require congressional approval. Many of the projects it supports are already under construction and have drawn bipartisan support from local, state and federal lawmakers.

“The president can only do so much in dealing with legislation,” said Heather Reams, president of Citizens for Responsible Energy Solutions, a conservative-leaning nonprofit.

But Trump alone could make it more difficult for companies and consumers to claim tax credits for buying electric cars or installing offshore wind projects. His administration could also pause grants and loans, creating uncertainty for companies.

Intersect’s Kimber hopes tax credits for wind, solar and energy storage will survive and expects the industry to put priority on using equipment made in America, a trend already spurred by the law.

Companies are expected to emphasize domestic operations and argue they bolster independence from China, which dominates clean-energy industries from EVs to solar panels. If Trump backtracks from the sector, China’s lead is expected to become even more intractable. A repeal of the climate law could cause some $80 billion in lost investment opportunities for the U.S. that other countries could seize, a Johns Hopkins study found.

A core challenge for clean-energy companies is that efforts to establish domestic supply chains are still in their infancy. That means high tariffs could push up equipment costs across the board. Renewable projects are also capital intensive, meaning expectations for higher borrowing costs are another obstacle.

“Those are two big input costs that these companies just took a big hit on,” said Catherine Wolfram, a former Biden administration energy economist who is now a professor at the Sloan School of Management at the Massachusetts Institute of Technology. She called the election result “gut-wrenching.”

An exchange-traded fund that tracks the sector slid more than 7% Wednesday, its biggest drop since March 2020, before stabilizing Thursday and falling again Friday. Names such as solar-panel maker First Solar were hit particularly hard. So were startups that have pending federal loan agreements such as hydrogen upstart Plug Power. An ETF tracking oil-and-gas stocks added about 6% for the week.

Many companies will apply a full-court press to urge Trump not to undo the law, building on lobbying that has been going on for months. Fossil-fuel executives who are some of Trump’s biggest backers are pushing to keep parts of the law that benefit their sector. Many in the industry opposed the law before it passed but now favor tax credits for low-carbon energy projects they are developing such as capturing emissions at industrial facilities.

Andy Marsh, Plug Power’s CEO, said the company has been discussing hydrogen tax credits with Republicans and Democrats for months. While expensive to produce, hydrogen is a potential replacement for fossil fuels in sectors such as fertilizer-making and aviation. The conversations included members of a group of 18 House Republicans who wrote a letter to Speaker Mike Johnson (R., La.) in August urging him not to push for a repeal of the law.

Plug Power began production at one of the nation’s first green hydrogen plants in southeast Georgia earlier this year.

Plug is vulnerable to Trump’s win because it has a nearly $1.7 billion loan commitment from the Energy Department’s Loan Programs Office. Such agreements could be in danger if they aren’t completed by inauguration day in January. Its shares fell 22% Wednesday.

The loan office, which has about $25 billion in pending loans, is racing to get the money out the door. Largely dormant during the first Trump administration, the program reviews deals for years to avoid losing taxpayers money after solar-panel startup Solyndra went bust after getting a $535 million loan.

Marsh is in regular contact with Energy Department officials and expects them to move even faster now. He is hopeful hydrogen tax credits will survive because oil companies are investing in the sector.

“It probably would have been better for us if it went the other way, but it’s certainly not the end of the world,” he said, referring to the election results.

Trump’s proposals for deregulation could benefit many clean-energy companies. And companies will still put money into the shift away from fossil fuels because wind, solar and batteries are increasingly cost competitive. “The incentive for companies to procure renewable-energy supply will still be there based on the economics,” said David Brown, director of the energy-transition practice at Wood Mackenzie.

“There’s rhetoric, then there’s reality,” said Neil Chatterjee, a former chairman of the Federal Energy Regulatory Commission during the first Trump administration who was replaced after he backed policies that would boost the role of clean energy in competitive power markets. He now advises companies on energy-sector issues at law firm Hogan Lovells.

Eric Niiler contributed to this article.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com and Scott Patterson at scott.patterson@wsj.com