World Bank reports the growing reach of carbon pricing around the globe

Note: CCL’s Jonathan Marshall summarizes the latest worldwide data on carbon pricing, per the World Bank, in a succinct essay and 3 key charts.

As we seek inspiration and validation of our support for national carbon pricing in the United States, many of us look for signs of growing adoption abroad. A new World Bank publication on the State and Trends of Carbon Pricing 2022 reports not only that more jurisdictions than ever are pricing carbon, but they are applying ever higher prices to a slightly greater share of total global emissions.

That’s the good news. The bad news is that global carbon pricing remains woefully inadequate to meet the challenge of holding global warming to 2°C. For that to happen, the world’s economy would need to face a carbon price in the range of $50 to $100 per metric ton of CO2 by 2030. Given consumer and voter unrest over the current turmoil in world energy markets, that’s a politically challenging target to say the least.

Here are a few of the report’s high-level findings:

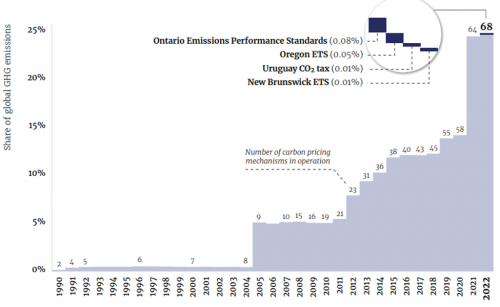

- As of this spring, 68 countries and subnational jurisdictions had carbon pricing initiatives (CPIs), with three more underway. New ones this year included a steep carbon tax in Uruguay and state or provincial initiatives in Oregon, New Brunswick, and Ontario.

- Nearly a quarter—23 percent—of global greenhouse gas (GHG) emissions are now covered by CPIs, a slight increase over 2021. The European Union’s huge Emissions Trading System (EU ETS), which covers power, industry, and aviation, will likely be expanded soon to encompass transportation and buildings.

- Carbon prices are going up, too. China, the world’s biggest emitter, recently instituted a carbon market covering more than 30 percent of its emissions, and prices jumped 13 percent in the first six months (albeit to a low level of only $8.50/tCO2). More dramatically, spot prices for emissions allowances in EU ETS, the world’s biggest carbon market, tripled over the course of 2021. A number of countries, including Canada, Ireland, and Switzerland, have price increases programmed into their national policies.

A good summary of measure the total impact of these three dimensions of carbon pricing effectiveness is global carbon pricing revenue, which reflects total emissions covered times the average carbon price. Last year those revenues reached a record $84 billion, about 60 percent higher than in 2020.

“Such an impressive increase highlights carbon pricing’s burgeoning potential to reshape incentives and investment toward deep decarbonization,” the report notes. “Further, it illustrates carbon pricing’s potential role as a broader fiscal tool to contribute toward broader policy objectives, such as to restore depleted public finances, aid pandemic recovery, or support vulnerable sectors and communities to adapt to climate impacts and achieve just transitions.”

Still, the World Bank report cautions that only 4 percent of global emissions are now covered by carbon prices high enough to keep global heating to less than 2°C. To meet a much more stringent target of 1.5°C, the report cites estimates that a global carbon tax might need to reach as high as $250/tCO2.

There’s lot more of interest in the report, including discussions of border carbon adjustments and the need for financing mechanisms to promote a “just transition” that will sustain public support for carbon pricing as the world undertakes rapid decarbonization. Both issues, of course, are addressed by the Energy Innovation and Carbon Dividend Act.