Rhode Island Adds Carbon Tax

- RI starts the process

- Good summary of other states’ efforts

Rhode Island’s carbon-pricing study is officially underway amid an uncertain future for local efforts to address the climate crisis.

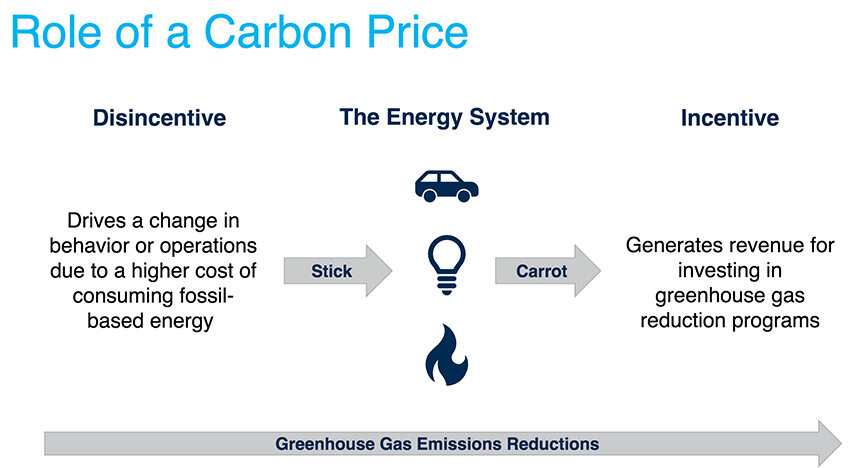

The concept of placing a fee on fossil fuels to pay for renewable-energy initiatives and/or encourage the transition to electricity-based transportation and heating has been advanced for three decades, with support from environmentalists and old-guard conservatives.

The concept of placing a fee on fossil fuels to pay for renewable-energy initiatives and/or encourage the transition to electricity-based transportation and heating has been advanced for three decades, with support from environmentalists and old-guard conservatives.

Forty-six countries participate in national carbon-pricing programs and another 31 programs are run by other entities, such as states and provinces. But getting them approved is difficult and may get harder with the COVID-19 health crisis and the economic slowdown.

Carbon-pricing proposals typically languish and die in state legislatures, and suffer defeat at the polls. Every New England state has a carbon-pricing bill but none have come close to passing. Washington twice defeated a carbon tax by referendum. So far, California is the only state with a true price on carbon.

After several carbon-tax bills died in committee, the Rhode Island Senate approved a carbon-pricing study in 2017. Settlement money from the Volkswagen emissions scandal was eventually offered up, in 2019, to pay the study’s $250,000 cost.

After an October 2019 kickoff meeting, the consultants offered an assessment last week of what a carbon-pricing program may look like. A proposal is expected to be released in late summer or early fall.

The program will likely be based on two models: cap and trade or a carbon fee. California and the multi-state Regional Greenhouse Gas Initiative use a cap-and-trade program, meaning the price to buy carbon offsets is determined by market demand. A carbon-fee program is typically set by an administrator. Both generate revenue that can fund renewable-energy programs, reduce taxes, or be returned to consumers as a dividend.

The impact of a program is determined by which fossil fuels are taxed and the price of the carbon offsets. California seems to be favored by the consultants for its overall effectiveness at reducing emissions and funding initiatives. Since 2013, California has reduced emissions by 16 percent by assessing a fee on fuels for transportation, power generation, and the heating sector. It has raised $9.3 billion for housing, renewable energy, transportation, electric vehicles, environmental restoration, and recycling. Thirty-five percent of these investments must be spent in disadvantaged and low-income communities.

California’s carbon offset trades in a mid-price range of about $18. By comparison, Japan sets its fee at $3 per metric ton and Sweden charges $123 per metric ton. Sweden, however, uses all of its revenue to reduce taxes.

The consultants for the Rhode Island study, the Cadmus Group and Synapse Energy Economics Inc., offered two preliminary scenarios: a low price of $6 per metric ton and a high price of $25. The low-price scenario would add about 5.4 cents to a gallon of gas. The $25 carbon allowance would add 23 cents to a gallon of gas. Both would ratchet up the cost of offsets by 5 percent annually. The low-price model lacks one of the primary principles of a carbon tax, a high gas price that pushes consumers to adopt cheaper forms of transportation, such as electric vehicles and/or public transit. A low fuel price simply reduces emissions by investing the revenue in renewable-energy and energy-efficiency initiatives.

The state report will consider the economic benefits of both scenarios. It also will explore the benefits of a regional program and the impacts on social equity. It will look at how the program would coexist with another carbon-pricing program the state is engaged in, the Transportation & Climate Initiative (TCI).

Rhode Island intends to launch the TCI program with other states in 2022, according to the Department of Environmental Management (DEM). If these dates are to be met, legislation for both the TCI and a broader carbon-pricing program would have to be approved by 2021.

The consultants for the carbon-pricing study want feedback from the public on the fees, how the revenue should be spent, and other ideas for the qualitative policy analysis.

Comments can be sent via email to Jesse Way of the Cadmus Group at jesse.way@cadmusgroup.com, Chris Kearns of the Rhode Island Office of Energy Resources at christopher.kearns@energy.ri.gov, or to DEM’s Elizabeth Stone at elizabeth.stone@dem.ri.gov. Comments must be received by May 29.